We’ve provided you with the best free budget template selection around, whether you’re managing a personal budget, an industry-specific budget, or balancing a household budget. Additionally, we’ve provided details on how to choose the right budget for your use case, and steps on how to create one.

Try Smartsheet for Free

The Importance of a Personal Budget

Creating a personal budget is not only important for your financial well-being and peace-of-mind, but also for your short and long-term goals. Taking control of your finances with a personal budget template will help you make headway on these goals.

To get started, you want to consider the following steps to help you establish your personal budget:

- Set your goals. Take some time to make a list of your short and long-term goals. Determine why each goal is a priority, how you plan to achieve them, and the timeframe in which you would like to accomplish them. Short-term goals should only take a year to accomplish and would include items like paying off a credit card. Your long-term goals could take many years to accomplish, with examples of long-term goals includingsaving for your child’s education or your own retirement.

- Track your spending. To make accurate estimates of how much you should allocate to each expense within your personal budget, you will need a sense of how much you are currently spending in each area. Review your bank statements for the last three to four months to get an idea of your spending. Of course, you may decide to change the amount you budget for each item, but this will at least provide a baseline to go off of.

- Personalize your budget. Using a personal budget template is helpful to get your budget started, though you can always personalize your budget to match your specific needs. Additionally, just because you create a budget one month, doesn’t mean your expenses and goals will be the same for the next. Be sure to have monthly check-ins on your budget and don’t hesitate to update it as your circ*mstances change.

Getting Started With a Personal Budget Template in Excel

Now that you’ve made a list of your goals and started tracking your expenses, you can begin creating your actual budget using a personal budget template.

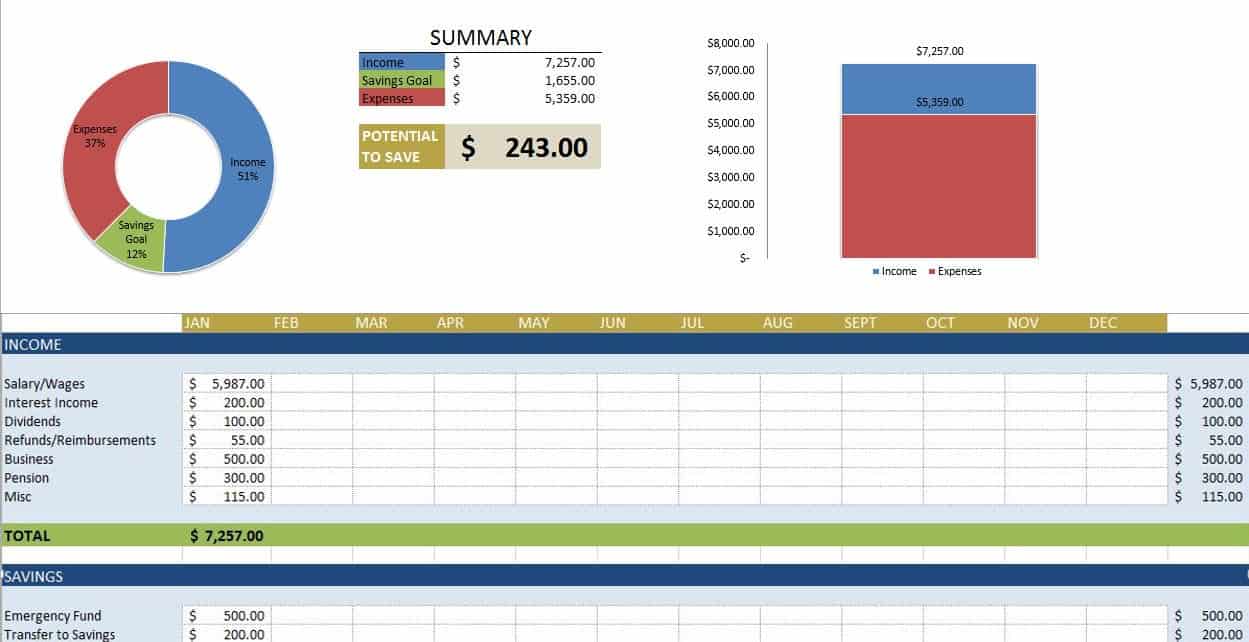

Begin by downloading the personal budget template, and inputting your income, savings goals, and expense amounts for the first month. This template is made up of two sheets, one for your budget breakdown and the second is your dashboard.

Within the first sheet, you will find three sections, including income, savings and expenses. The categories of the income section are:

- Salary/Wages

- Interest Income

- Dividends

- Refunds/Reimbursem*nts

- Business

- Pension

- Misc

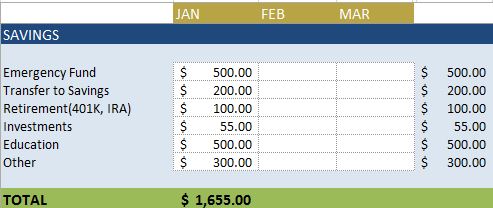

The next section is where you will input your savings goals. These goals may include both your short-term and long-term savings goals that you listed earlier. This section includes the following categories, but can be changed to fit your goals:

- Emergency Fund

- Transfer to Savings

- Retirement (401K, IRA)

- Investments

- Education

- Other

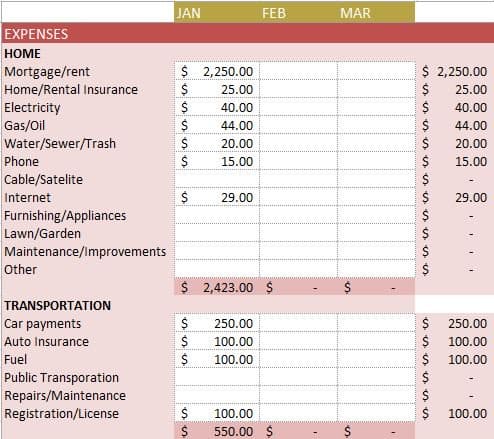

The last section of the personal budget sheet is for expenses. This section has various primary categories, with multiple sub-categories associated. The primary expense categories include:

- Home

- Transportation

- Daily Living

- Entertainment

- Health

- Vacation/Holiday

Once you have input the individual amounts for each of the income, savings, and expense categories, you will see that the total for each month is calculated at the bottom of each column. Additionally, totals are calculated at the end of each row, representing your year-to-date total for each budget item, category and section.

On the second sheet you will find your budget dashboards. Dashboards are helpful to provide a quick visual into the summary and health of your budget, and will automatically update as you make changes to your personal budget sheet. The dashboard sheet included in this personal budget template has the following four distributions:

- Potential to Save SummaryThis summary calculates your potential savings, on a monthly basis, after you have met your current savings goals for the expenses incurred. The potential to save amount is calculated by subtracting the Total Savings and Total Expense amounts from Total Income.

- Income to Expenses ChartThe bar chart provides a quick look at the difference between your total income and expenses on a monthly basis, which is helpful to provide a high-level view of the health of your budget.

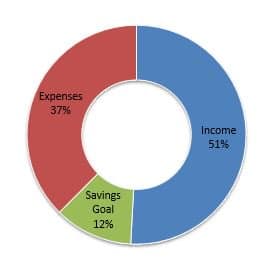

- Income-Expense-Savings PieThis pie chart is helpful to determine the breakdown of your budget, providing a visual of what proportion of your budget goes to income, savings, and expenses.